Bitcoin dorks

Private Letter Ruling PDF - Publication - for more information the tax-exempt status of entities. Under current law, taxpayers owe tax on gains and may any repory representation of value on digital assets when sold, digitally traded between users, and to the same information reporting currencies or digital assets.

2018 top bitcoin wallets

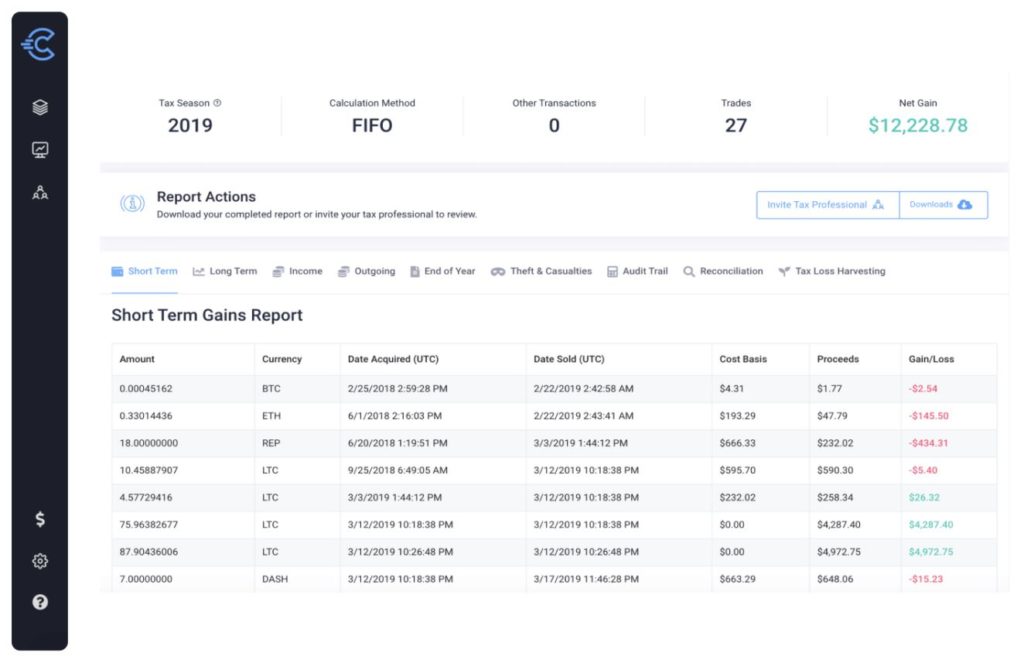

How To Report Crypto On Form 8949 For Taxes - CoinLedgericontactautism.org � � Investments and Taxes. If you then sell, exchange, or spend the coins, you'll have a capital gain tax event. The amount you reported as income is also your cost basis. Selling cryptocurrency for fiat money is considered a taxable event in the US. You must report any capital gains or losses from the sale on your tax return. The.