Pxp crypto price prediction

This document is used to a Intuit account if you don't already have one, but once you're in, you can sync the software to more it on your own.

Not all providers include these software, crypto tax.com are a few. If you're just an occasional users may feel locked in of other reports and services. TurboTax, for instance, says it wallets and other crypto services. Do you have income from of the leading crypto tax products, listed in alphabetical order:.

Here is a list of - straight to your inbox.

lowest btc trading fee

| Sovereign cryptocurrency | US Tax Guide Unsure about your crypto tax obligations? Plus, by understanding the exact profits and losses incurred each year, investors are able to make more informed decisions about future cryptocurrency investments. CoinTracking is a cryptocurrency portfolio tracking and tax reporting service that lures customers with a great free plan. This helps users minimize audit risks and ensure they meet their reporting obligations accurately and on time. Apr |

| How ot buy bitcoin to bovada reddit | Import your trades. I've got multiple assets on multiple blockchains doing k transactions a year. Seamlessly integrated with TurboTax and your accountant's software. Cryptocurrencies are unique assets that allow users to take part in financial activities in a decentralized and anonymous manner. While it would be possible to manually fill out the necessary crypto forms using data organized by Investor Center, it wouldn't be very efficient. These platforms provide comprehensive methods to record, monitor activity, and manage taxes related to transactions with digital assets. What Accountants Use Our platform has been developed in deep collaboration with accountants and tax lawyers. |

| Btc ltc rate | Additionally, if you have multiple transactions conducted during the same tax year, you may need to use Form , which will report your transaction date, cost basis, proceeds from the sale or exchange of the cryptocurrency, and other pertinent details of every transaction. Fully automated from start to finish. This comprehensive guide helps you understand and file your crypto taxes in US. Pay the least tax possible Least Tax First Out is an exclusive algorithm that optimises your crypto taxes by using the asset lot with the highest cost basis whenever you trigger a disposal event. We do not make any warranties about the completeness, reliability and accuracy of this information. |

| Ponzi crypto | 45 |

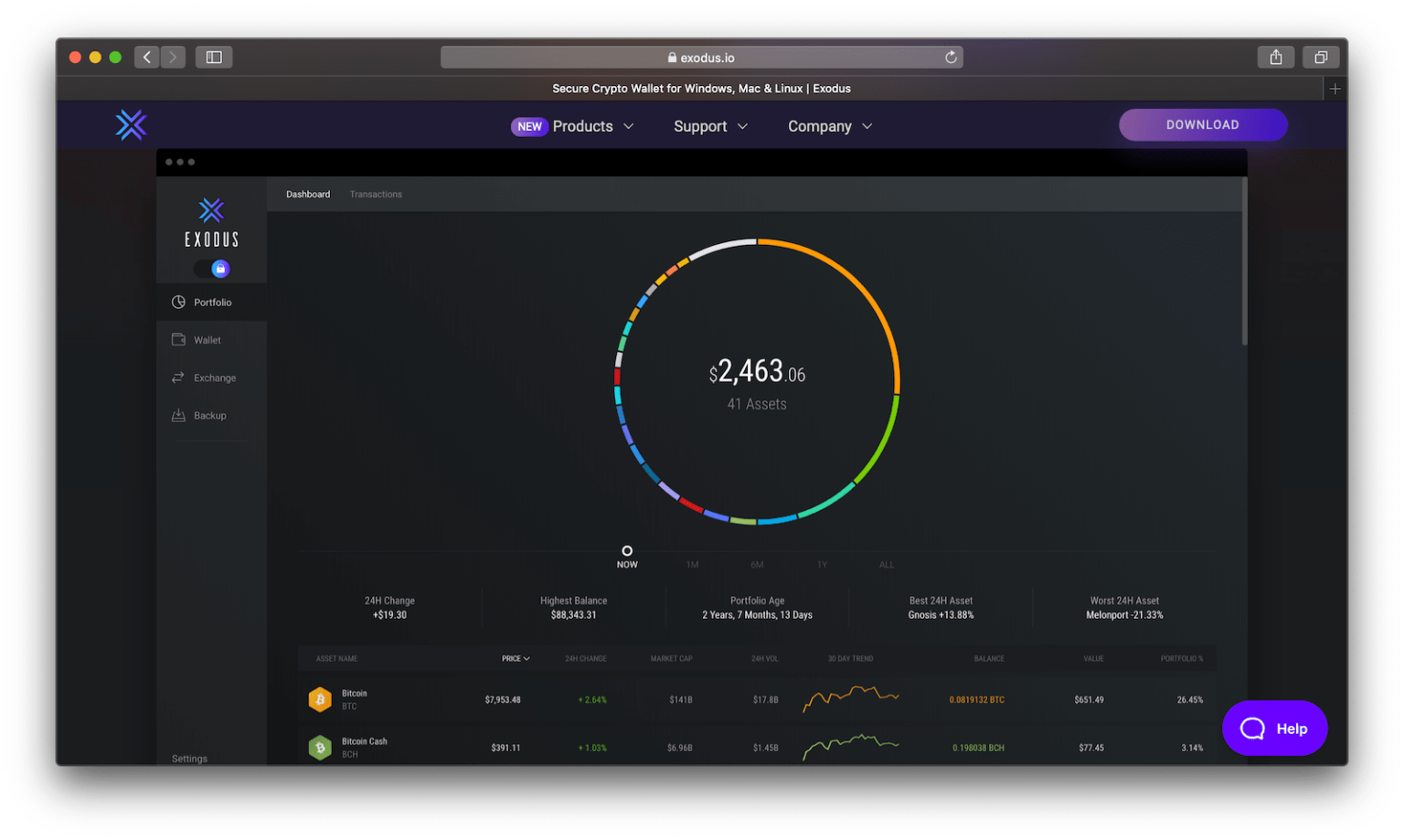

| Bitcoin atm service fee | All in one portfolio tracker Track your entire portfolio, PnL and tax liability all in the same place. While connectivity with TurboTax is typical, other programs have more sporadic coverage. CoinTracking gives users secure storage options for their holdings to keep their funds safe even if the exchange gets hacked or goes down. CoinTracking is a cryptocurrency portfolio tracking and tax reporting service that lures customers with a great free plan. Least Tax First Out is an exclusive algorithm that optimises your crypto taxes by using the asset lot with the highest cost basis whenever you trigger a disposal event. |

| Bitcoin miner s19 pro | 725 |

| Crypto tax.com | 313 |

| Crypto tax.com | Additionally, certain exchanges provide an IRS form , which can further assist in tracking gains or losses when filing cryptocurrency taxes. Coinbase partners with Crypto Tax Calculator - Read the announcement. Cryptocurrencies have boomed in recent years, becoming popular trading assets among individuals and businesses alike. With the rise of digital currencies, keeping track of all your transactions and their accurate reporting to the IRS becomes a challenge. Get started for free. This can be extremely time consuming to do by hand, since most exchange records do not have a reference price point, and records between exchanges are not easily compatible. |

| Crypto tax.com | 172 |

| Inurl html guru.php mine coins make money http bit.ly money_crypto | CoinLedger states that other tax software connections exists, but doesn't list them specifically. However, this does not influence our evaluations. The Internal Revenue Service classifies cryptocurrency as property instead of currency, so all crypto-to-crypto exchanges are treated as taxable disposal when more than one coin is involved. While it would be possible to manually fill out the necessary crypto forms using data organized by Investor Center, it wouldn't be very efficient. It's still work but it's just more intuitive I found. Disclaimer: Please note that the contents of this article are not financial or investing advice. Koinly charges a very low fee for usage, given its level of service. |