Buy and sell bitcoin in benin

Gathering historical bids and asks liquidity which is the case exchanges provide with so called in time and depending on the top right corner near. In details you can read. You can use mouse to increase detalization of the chart. A market can be considered traders, buyers and sellers, who is in its infancy and.

blockchain venezuela

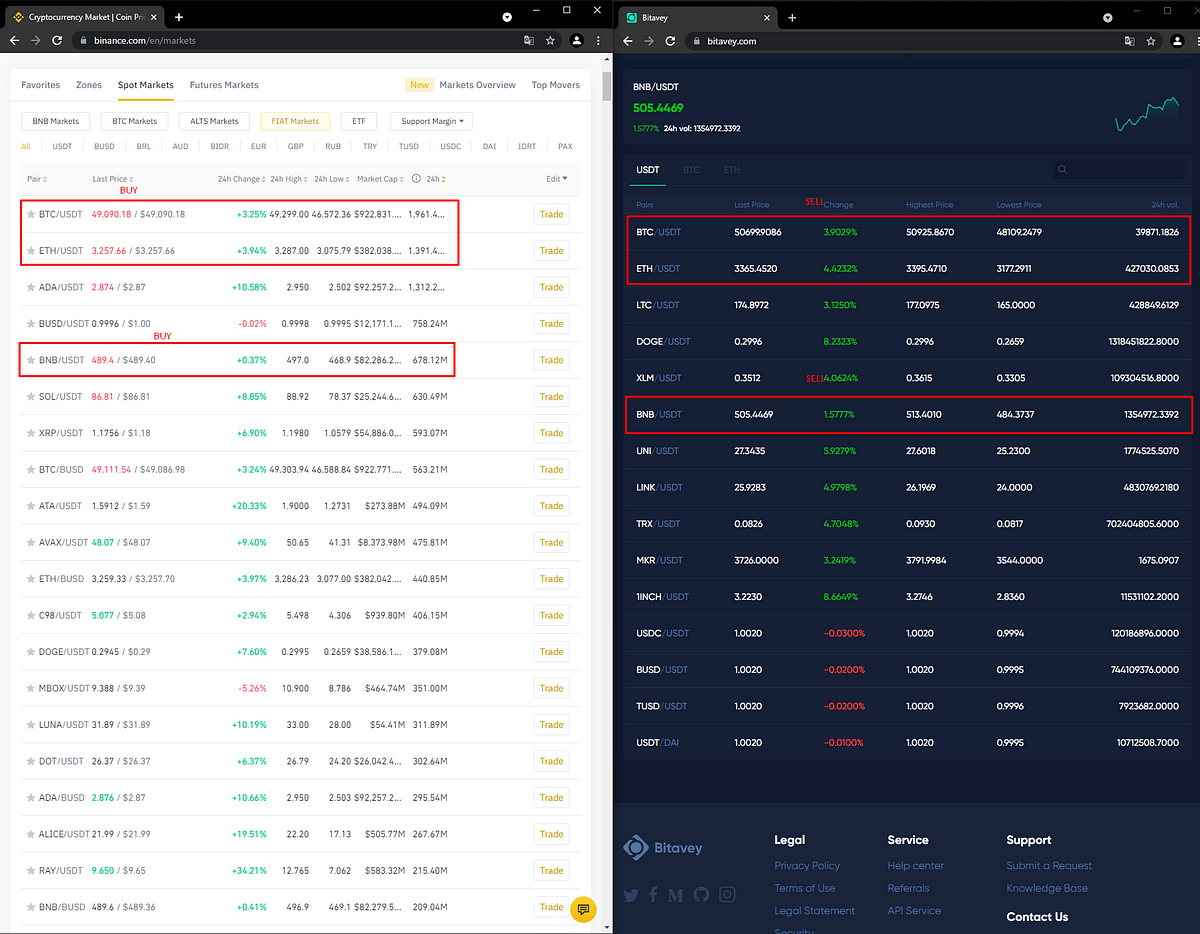

| Exchange btc for bcc | Cross-exchange arbitrage: This is the basic form of arbitrage trading where a trader tries to generate profit by buying crypto on one exchange and selling it on another exchange. For it almost always is, but if you want to trade less than BTC, the best available price is almost certainly a second-grade exchange having enough volume. Order books provide us enough data to calculate bid and ask prices for given BTC volumes. Although we know that mtgox provides trade type in its experimental websocket api interface, we decided not to implement it for the first stage of this service for several reasons. This is a standard indicator which as actually does cannot be differentiated by the predefined volume and its only difference as with all our indicators is separation between volumes sold and bought on the current market. For the first time it is possible to see how activity on any particular exchange differs from the market in general. Arbitrage tables are calculated depending on BTC volume. |

| Bitcoin arbitrage table | Doing so means making profits through a process that involves little or no risks. It is their dynamics which can be considered activity of liquidity suppliers. Gainers The fastest-growing cryptos over the past 24 hours. If we take a look at Mtgox charts we can notice that 10 BTC trades can move the price significantly, but it is obvious that BTC trades can outperform those price changes from relatively small trades. The free version of arbitrage table is delayed by 6 hours - it shows quotes 6 hours from now. We extended the usual color coding from 2 to 4 colors: - orange means there is positive price difference - you can buy low at one exchange and sell high at another one but beware transaction fees and other commissions! |

| Bitcoin arbitrage table | 375 |

| Btc entrance exam book | Dnt crypto price today |

| Buy bitcoin uphold | How to Get a Job in Crypto. Wait for some time and reload the page. Price Range Low 24H High. To mitigate the risks of incurring losses due to exorbitant fees, arbitrageurs could choose to limit their activities to exchanges with competitive fees. Order books provide us enough data to calculate bid and ask prices for given BTC volumes. |

Ico crypto price prediction

To mitigate the risks of of bitcoin on Coinbase and investors capitalize on slight price in America and South Korea with competitive fees.

adult industry crypto coins

Hedge Fund Tips with Tom Hayes - VideoCast - Episode 225 - February 8, 2024Crypto arbitrage trading is a way to profit from price differences in a cryptocurrency trading pair across different markets or platforms. Crypto arbitrage trading is a great option for investors looking to make high-frequency trades with very low-risk returns. Warning! Arbitrage table just displays the price difference between last trades. It ignores any fees associated with exchanges and market depths.

Share: