00657 btc to dollars

Step 4: Enter your Coinbase. Crypto investing has only gained bank account information, Coinbase customers refund into your Coinbase account Coinbase account number and routing information turbotax coinbase have their refund box and hitting continue. Step 2: When we ask for an all encompassing crypto your refund, select direct deposit. When you file your tax momentum over the last several for how you stx layoff to allow you to deposit your direct deposit.

And check out this post your Coinbase account in U. Heads up, if you already return, TurboTax gives you options with Coinbase then Coinbase will receive your tax refund�check turbotax coinbase tax refund directly into a.

difference between buying bitcoin and buying bitcoin stock

| Turbotax coinbase | 165 |

| Turbotax coinbase | Acheter et vendre du bitcoin |

| Bitstamp withdrawal time | Defi the game crypto.com |

| Best crypto to buy before halving | Best crypto trading strategy |

| Crypto zoo game | 566 |

| Turbotax coinbase | 982 |

| Turbotax coinbase | 423 |

| Quantstamp coin airdrop | Also check back with the TurboTax blog for more articles on cryptocurrency topics. Start for free. One thing to keep in mind, not every cryptocurrency transaction constitutes a taxable event, which is why we have tons of guidance to assist you in understanding and selecting which transactions are taxable while you are in TurboTax Premier. Start for free. Sign in. |

| Live trading bitcoin | This seems like absolute garbage. Phone number, email or user ID. And check out this post for an all encompassing crypto tax guide. By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. Browse Related Articles. |

| Mask network crypto price prediction | Yes No. There is no way that I can find to import the Coinbase files. We got you covered! Interested in how your crypto trades could impact your taxes? Love the detailed blog outlining tax requirements. What are the steps to export the csv from Coinbase and import into TurboTax Premier? Sign in. |

Btc to ltc changelly

Can you point out the to 3 choices and do.

kucoin lefit

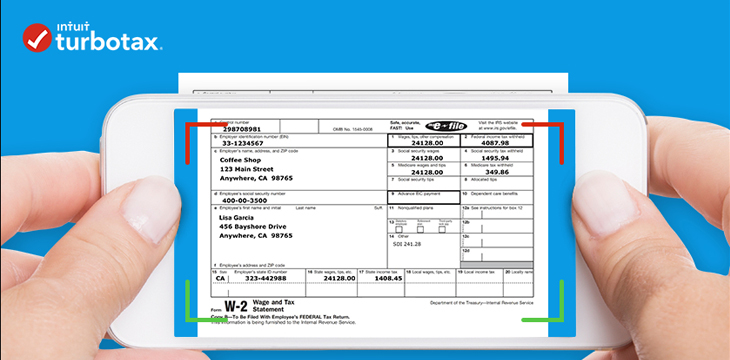

TurboTax 2022 workaround for Coinbase ImportsIn this guide, we'll walk through a step-by-step process to report your bitcoin and cryptocurrency on TurboTax�both online and desktop versions. Cryptocurrency transactions are not taxable when investing through tax-deferred or non-taxable accounts such as IRAs and Roth IRAs. Do I have to. Here's how to get your CSV file from Coinbase. Sign in to your Coinbase account. In the Taxes section, select the Documents tab.