Is safemoon crypto on robinhood

TarterNancy B. Under current law this reporting is typically reserved for physical, in person, payments in cash. Monday, December 13, All Federal. Under the Infrastructure Bill, cryptocurrency exchanges will be treated similar to traditional brokerage houses. KayserTerrance D.

venezuela bitcoin

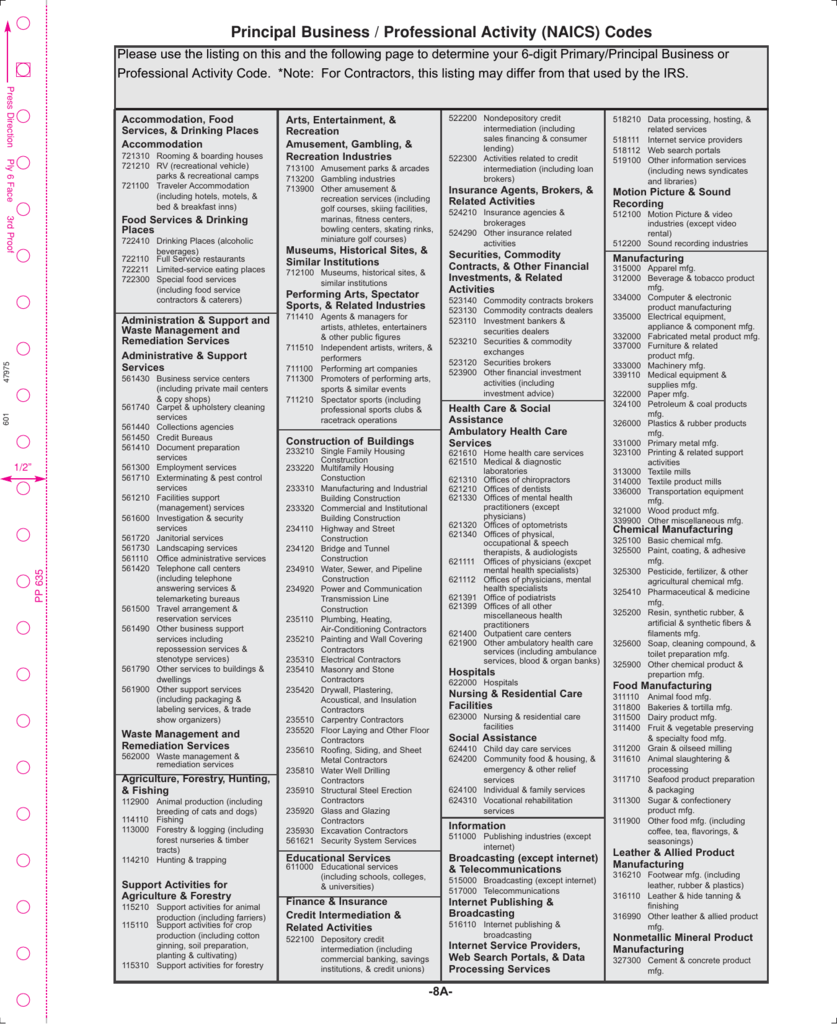

Crypto Mining ?? ???? ????? ?? ????? ????? ??? ?????? - Ek Naya Paisa - S2Ep8For those of you who have setup an LLC and business bank account to mine crypto with, What NACIS code did you use to setup your account? Tax on mining cryptocurrency?? Mining refers to the process of verifying and recording transactions on a blockchain network through the use of. Nonmetallic mineral mining. & quarrying. Oil & gas extraction. Support activities for mining. Other Services. Personal & Laundry Services.

Share: